In the modern era of digital transactions, reliable and secure payment services are crucial for businesses and customers alike. This need is particularly pronounced in Dubai, a global hub of commerce and innovation. To meet the growing demand for secure payment solutions, Tap Payment Gateway offers a cutting-edge platform that revolutionizes online transactions while prioritizing security.

In this comprehensive article, we will delve into the features and benefits of Tap Payment Gateway, how it caters to the unique needs of Middle Easten online businesses, its pricing structure, and the process of getting started with this game-changing solution.

Tap Payment Gateway Overview

Tap, founded in 2013 in Kuwait, aims to revolutionize online transactions and empower businesses across the Middle East. Recognizing the unique challenges faced by businesses and consumers in the region, Tap has developed an innovative platform that simplifies payments and bridges the gap between local and global e-commerce.

With a proven track record of supporting over 1,000 businesses and major corporations, Tap has facilitated tens of thousands of secure transactions worldwide. As a leading payment services provider, Tap operates in Saudi Arabia, Kuwait, Bahrain, UAE, Qatar, Oman, Egypt, Jordan, and Lebanon, solidifying its presence across the region.

Experience the convenience and efficiency of Tap Payment Gateway as it transforms the way Middle Eastern businesses conduct online transactions, paving the way for seamless growth and success.

Tap Payment Gateway’s Robust Security Measures

Tap Payment Gateway places utmost importance on security, employing robust risk detection measures, advanced protection tools, and authentication processes. The platform’s hyper-intelligent risk detection thoroughly analyzes every transaction to identify potential risks across various devices.

By implementing comprehensive safeguards, Tap enables businesses to process risk-free transactions and prevent payments that exceed acceptable risk levels. Moreover, Tap provides specialized teams to assist businesses in safeguarding against cyber payment fraud, offering an added layer of security and peace of mind.

To maintain the highest level of security, Tap adheres to global PCI DSS security standards and incorporates banking-industry security levels and encryption protocols. By prioritizing the safety of businesses and customers, Tap establishes a secure online environment for all transactions, ensuring that sensitive payment information remains protected.

Key features of Tap Payment Gateway

Among many prominent payment gateways, Tap Payment Gateway offers a range of powerful features that empower businesses and enhance the payment experience for customers. These features include:

- Acceptance of Local, Regional & Global Cards: Tap enables customers to make payments using their preferred local, regional, or international credit cards, such as KNET, Benefit, Mada, Sadad, Visa, MasterCard, and American Express. This versatility ensures that businesses can cater to a diverse customer base, both within Dubai and internationally.

- Charge API: Tap introduces an innovative technology that allows businesses to accept online payments using a single API endpoint action. This simplifies the development process and provides customers with a seamless payment experience, reducing friction and optimizing conversion rates.

- Support for Multiple Currencies: Tap’s payment gateway accommodates various currencies, including major global currencies and those specific to the GCC region. This enables businesses to expand internationally and accept payments in different currencies, facilitating cross-border transactions and eliminating conversion hassles for customers.

- Dynamic Currency Converter: Tap payment gateway offers real-time currency conversions during transactions, providing customers with up-to-date currency exchange rates. This eliminates the need for additional research and offers a transparent payment experience, ensuring that customers have a clear understanding of the total amount they are paying.

- Card Saving: Tap allows customers to securely save their card information for future transactions, ensuring a speedy and convenient checkout process. This feature simplifies the payment process for returning customers, reducing friction and improving customer satisfaction.

- Schedule and Subscriptions: Businesses can schedule future payments and offer auto-renewing subscription services, simplifying payment management for both businesses and customers. This feature is particularly beneficial for businesses that offer subscription-based services or products, as it automates the payment process and ensures seamless recurring payments.

Benefits for Merchants

Tap Payment Gateway provides numerous benefits for businesses, including:

- Enhanced Customer Experience: By providing a seamless payment experience, Tap enables businesses to improve customer satisfaction and loyalty. The platform’s user-friendly interface, smooth integration, and wide range of payment options ensure that customers can easily complete their transactions, leading to higher conversion rates and repeat business.

- Comprehensive Reporting and Analytics: Tap’s intuitive dashboard provides businesses with detailed insights into transaction data, allowing them to monitor sales, track revenue, and analyze customer behavior. This valuable information enables businesses to make data-driven decisions, optimize their marketing strategies, and identify growth opportunities.

- Streamlined Accounting and Receipts: Tap simplifies accounting processes by generating electronic receipts that can be easily accessed and sent via email or SMS, reducing paper waste. These receipts are securely stored for historical purposes, providing businesses with accurate financial records.

- Organized Customer Data: Tap links customer payments to unique customer accounts, facilitating easy management of future payments and customer support. This centralized database allows businesses to provide personalized services and targeted marketing campaigns based on customer behavior and preferences.

- Effortless Refund Management: With Tap’s goSell service, businesses can easily process refunds with a single click. Detailed refund records are available for reference and tracking, streamlining the refund process and ensuring transparency for both businesses and customers.

Benefits for Customers

Tap Payment Gateway prioritizes the customer experience by providing:

- Seamless and Convenient Payment Experience: Customers can enjoy a smooth and hassle-free payment process, ensuring a positive overall shopping experience. With Tap, customers can complete transactions swiftly and securely, minimizing friction and enhancing satisfaction.

- Multiple Payment Options: Tap supports various payment methods, catering to diverse customer preferences and allowing them to choose their preferred payment option. Whether it’s credit cards, debit cards, or local payment methods, customers can make payments using their preferred method, ensuring a convenient and personalized experience.

- Enhanced Security Measures: Tap’s stringent security protocols safeguard customers’ private data, providing them with peace of mind during online transactions. By employing cutting-edge encryption and authentication technologies, Tap ensures that customer information remains confidential and protected from potential threats.

Cost-effective Pricing and Fees

Overview of Tap Payment Gateway’s pricing structure

Tap Payment Gateway provides two payment processing options: GoCollect and GoSell.

GoCollect is a payment processing service designed for individuals or small businesses who do not have a website or an online store. Let’s say you have an Instagram account where you sell cupcakes from your home. When a customer places an order through WhatsApp, you can provide them with a link to the Tap website to make the payment using a debit or credit card. There is no setup fee for this service, and you can sign up for it easily on the Tap website. With GoCollect, you can be up and running within 24 hours.

Tap’s revenue comes from transaction fees. They charge 2.5% per debit card transaction and 3% for credit card transactions. Once the payment is processed, Tap deposits the money into your account. You don’t have to worry about dealing with a specific bank either, as they work with all local banks.

GoSell, on the other hand, is designed for businesses that have an online store. If you sell products like t-shirts and have an e-commerce website using Shopify, Magento, or other online platforms, Tap provides a plugin (or API for professionals) that allows you to integrate their payment system into your e-commerce website.

The setup fee for GoSell is approximately KD 300, which may vary depending on the size of your business. Similar to GoCollect, Tap charges 2.5% per debit card transaction and 3% for credit card transactions, without any monthly fees.

When comparing Tap Payment Gateway with other payment gateway providers in the region, Tap stands out with its flexible pricing structure. Unlike some providers that charge monthly fees or require a minimum transaction volume, Tap only charges transaction fees without any additional fees or commitments.

Overall, Tap Payment Gateway offers a competitive pricing structure with efficient payment processing services, making it a great choice for businesses of all sizes.

How to Get Started with Tap Payment Gateway

Same Day Activation

Tap understands the importance of time, which is why they offer same-day activation for their payment gateway service. You can set up, connect, and start collecting payments in less than 24 hours. The online registration system provided by Tap guides you seamlessly through all the required steps, ensuring a hassle-free experience.

However, if you prefer a more personalized touch, their team of dedicated onboarding assistants is available via live chat or phone support to assist you and expedite the activation process.

Seamless Integration with Multiple Banks

Tap Payment Gateway ensures effortless integration with every bank in Kuwait, enabling you to effortlessly link your Tap gateway to your preferred bank account. This streamlined process allows you to swiftly start receiving payments without any unnecessary delays.

As a renowned payment service provider, Tap Payments goes beyond Kuwait and is connected to all the leading banks in the nine countries they currently operate in, including Saudi Arabia, Kuwait, Bahrain, UAE, Qatar, Oman, Egypt, Jordan, and Lebanon. This extensive network of banking connections further enhances the convenience and accessibility of Tap’s services.

Additionally, Tap offers you the flexibility to switch from one bank to another seamlessly while utilizing their payment gateway. With Tap, there are no cumbersome tasks or complicated procedures involved. Embrace the freedom to adapt your banking preferences effortlessly, without any hold-ups or obligations.

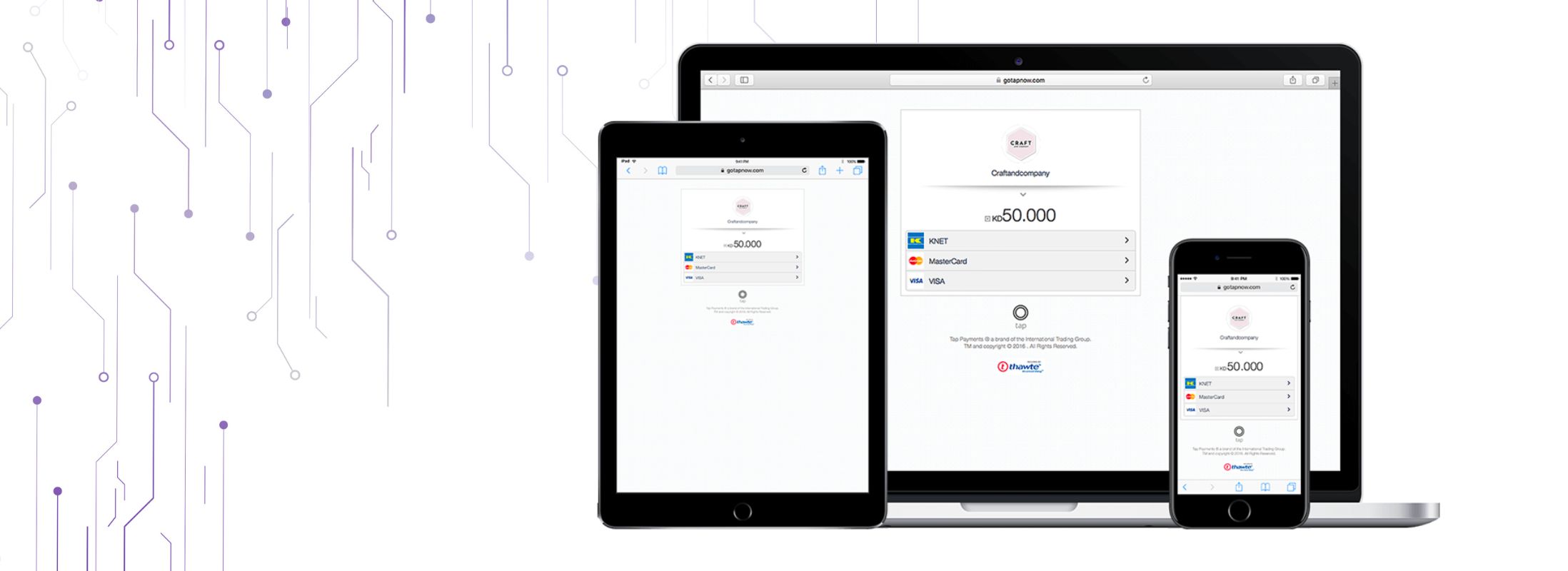

Integration with popular e-commerce platforms

Tap Payment Gateway offers seamless integration with a variety of popular e-commerce platforms and online marketplaces, ensuring compatibility with your existing systems. Some of the platforms Tap can integrate with include Magento, Shopify, Prestashop, OpenCart, Ecwid, and more.

Tap provides comprehensive API documentation, enabling developers to easily integrate Tap with their e-commerce websites. Alternatively, you can use connector extensions that simplify the integration process. For example, if your website is built on Magento, you can quickly connect with Tap Payment Gateway by installing Tigren’s free Magento 2 Tap Payment Gateway extension.

Mobile SDK

If you are building an iOS or Android app for your business, Tap offers Mobile SDKs that simplify API integrations and expedite the development process. By adopting Tap’s Mobile SDKs, you can save a significant amount of time and effort that would otherwise be spent on lengthy API implementation.

Additionally, by using Tap’s Mobile SDKs, you gain access to powerful features right out of the box, such as local, regional, and global card acceptance, multi-currency support, dynamic currency conversion (DCC), card saving capabilities, and subscription management.

Support and resources available for merchants

Tap Payment Gateway prides itself on providing exceptional support and resources for merchants. Their dedicated team is available via live chat, email, and phone to assist businesses with any inquiries or concerns they may have.

Tap’s support team is committed to providing timely and effective assistance to ensure a seamless payment experience for merchants. In addition to their responsive support, Tap offers comprehensive documentation, guides, and tutorials to help businesses optimize their utilization of the payment gateway.

Wrapping Up

Tap Payment Gateway integration is the ultimate choice for businesses looking for a secure, reliable, and convenient payment solution. With its array of advanced features, robust security measures, and seamless integration options, Tap empowers businesses to establish a strong online presence, cater to diverse customer preferences, and optimize their overall operational efficiency.

By harnessing the power of Tap Payment Gateway, e-businesses can unlock their full potential and embrace a seamless and secure online payment experience. Whether it’s through their flexible pricing structure, same-day activation, or comprehensive support, Tap is dedicated to helping businesses thrive in the digital landscape and achieve success in the ever-evolving market. Trust Tap Payment Gateway services to revolutionize your payment processes and propel your business forward.

Related Post: