The United Arab Emirates (UAE) is a country that has been experiencing rapid growth in the e-commerce industry, with a projected market volume of US$6,854.2 million by 2027.

With the rise of online shopping in the region, the demand for secure and seamless payment gateways in the UAE has become more crucial than ever.

In this article, we’ll delve into the top payment gateways available in the UAE, exploring their features, costs, and how they can help elevate your online business.

1. Telr

Undoubtedly, Telr is one of the most well-known payment gateways in the UAE, which can provide multiple popular payment options.

Now, it supports more than 100 countries and constantly updates more payment options.

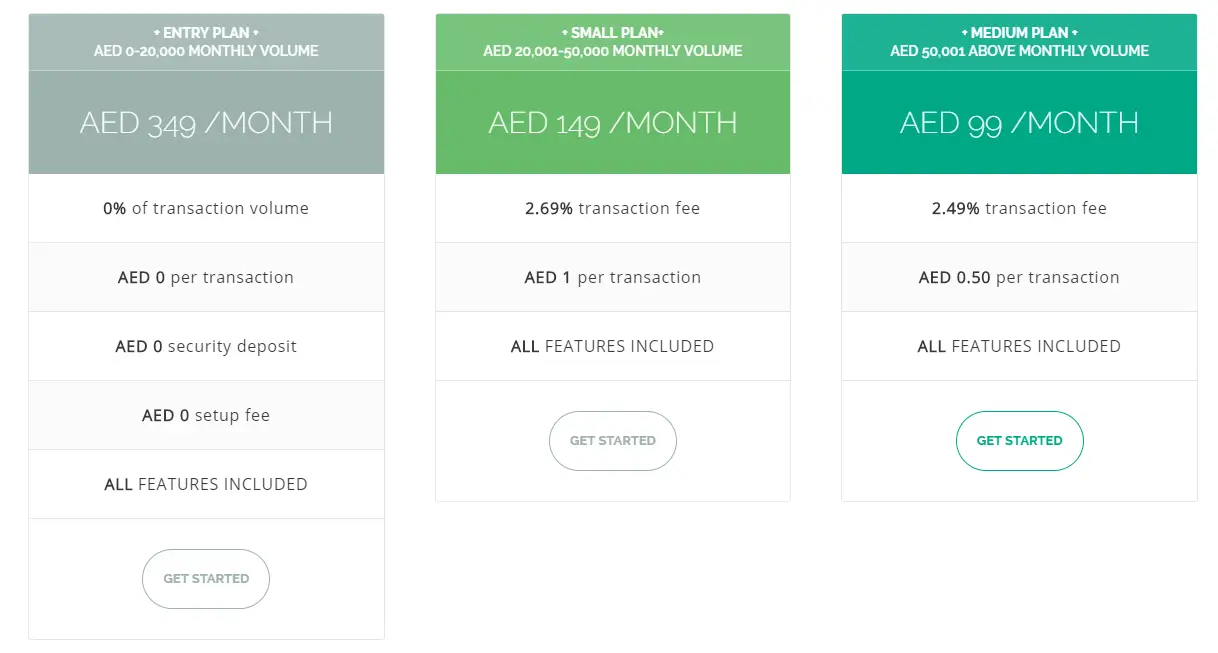

There are three payment levels: Entry, Small and Medium, which are great for startups, SMEs, and online businesses in the emerging market.

Reference Cost: There are 3 options for you: AED 349/month (Entry) | AED 149/month+ Transaction Fee (Small) | AED 99/month + Transaction Fee (Medium). You can select the most appropriate plan based on your monthly volume.

2. Amazon Payment Services

The second prevalent online payment gateway in UAE that we want to suggest is Amazon Payment Services formerly known as Payfort, operating in Arabic-speaking and surrounding countries such as UAE, Egypt, Saudi Arabia, Lebanon, Jordan, and Qatar.

This payment gateway accepts and proceeds multiple online payment options with high security in order to minimize transaction risks on your site and boost your revenue.

Since this payment gateway is tailored to Arab online buying habits and trends, it would be a perfect payment gateway solution for your virtual store.

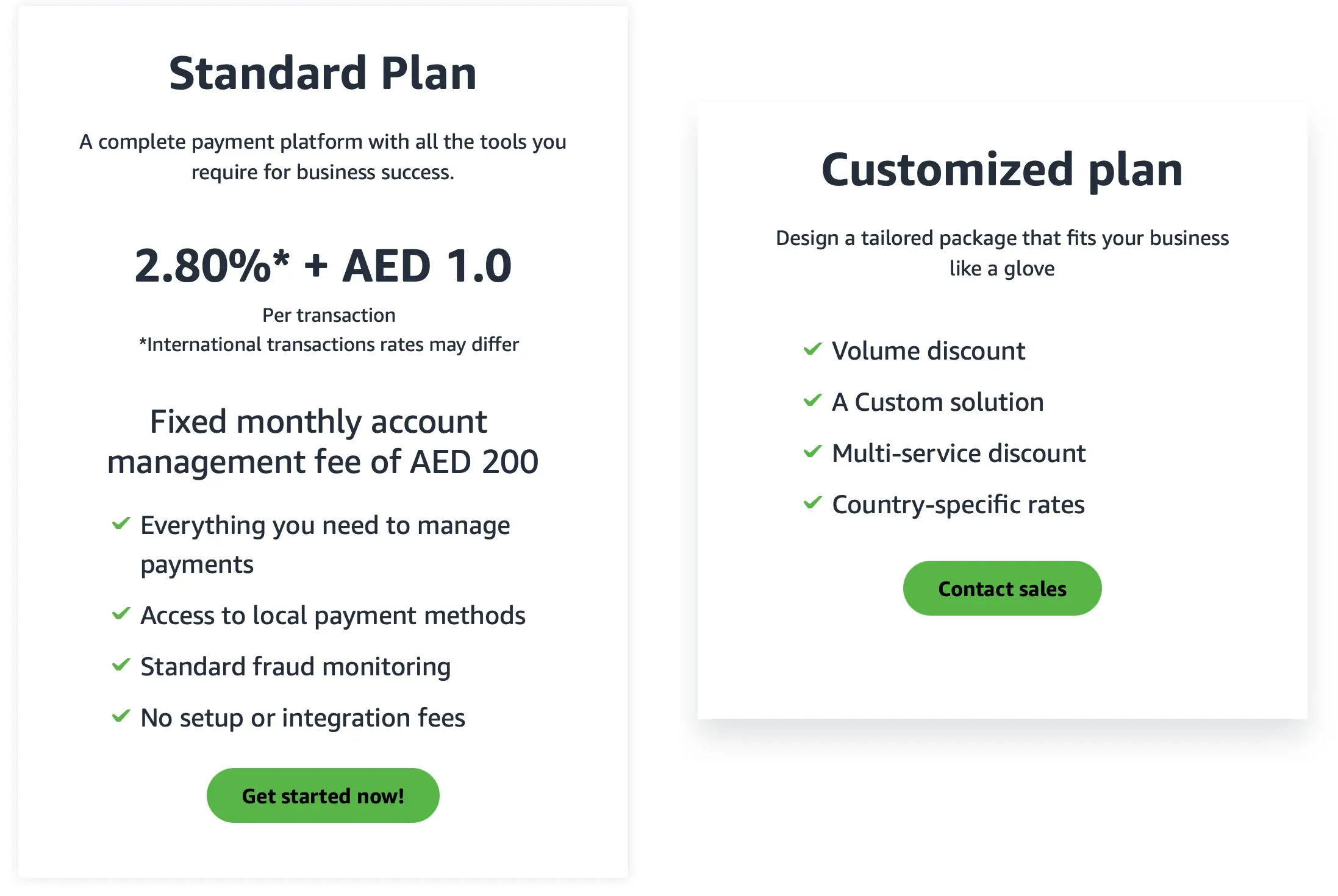

- Standard Plan: if your monthly transaction volume is less than AED 300,000.

- Customized Plan: if your monthly transaction volume is greater than AED 300,000.

Reference Cost: It’s worth noting that you will not be charged the setup fee. The monthly fee is AED 200 + the Transaction Fee (2.80% + AED 1.0) for the Standard Plan.

3. Checkout.com

Founded in 2012, Checkout is a leading international eCommerce gateway provider of online payment solutions.

In 2014, Checkout provided services to UAE, and it offered a streamlined payment gateway solution for mobile and online purchasing.

For UAE and other countries in the Middle East, Checkout offers 5 payment methods, namely VISA, Mastercard, JCB, Mada, and American Express.

Reference Cost: Contact the checkout.com team and you’ll get a tailored pricing plan that is based on your needs.

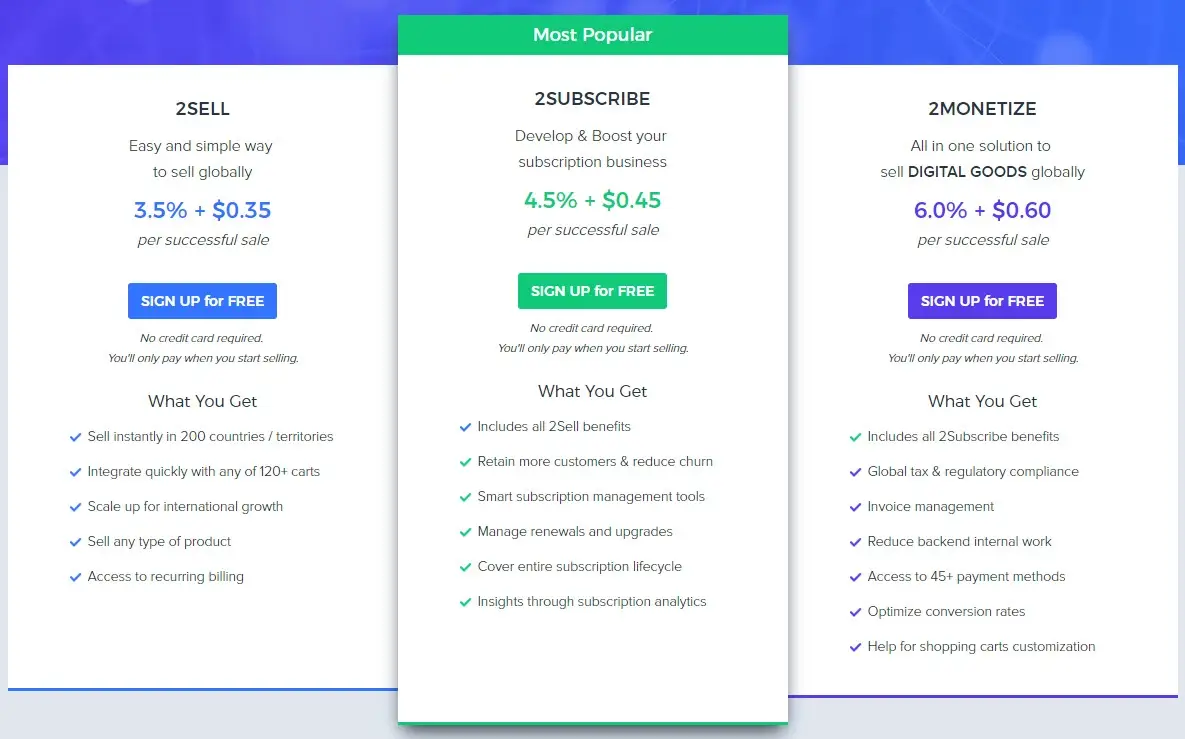

4. 2checkout

Founded in 2006, this is an international payment gateway in UAE that develops trading services, including credit cards and debit cards.

In UAE, 2checkout provides 10 payment methods, including American Express, Apple Pay, Bank Transfer, JCB, Mastercard, Neteller, PayPal, PO, Skrill, and VISA.

This convenient payment gateway has spread its reputation to more than 200 countries up to now.

Reference Cost: The setup cost is around AED 180 with a relatively high transaction fee (4.7% + AED 1.73 on average). In return for that, you will have an absolutely safe and convenient payment gateway.

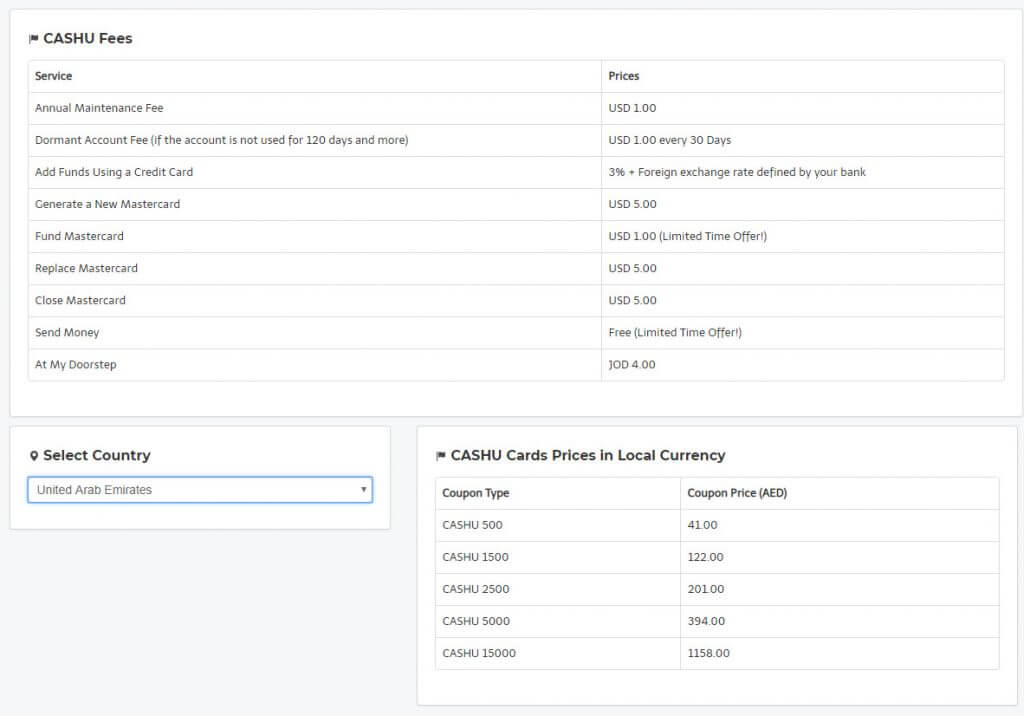

5. Cashu

Located in Dubai, UAE, Cashu is considered the first and the largest online payment solution company in the Middle East and North Africa (MENA).

This payment gateway applies modern fraud prevention and AML systems to avoid all risks associated with online transactions.

Every transaction is guaranteed without any risk of chargeback.

With Cashu payment gateway, you will have a lot of opportunities to grow your business across markets on both a local and global scale.

Reference Cost: A setup fee and security deposit will be required.

The annual fee of this payment gateway depends on the total number of products sold or the volume of sales.

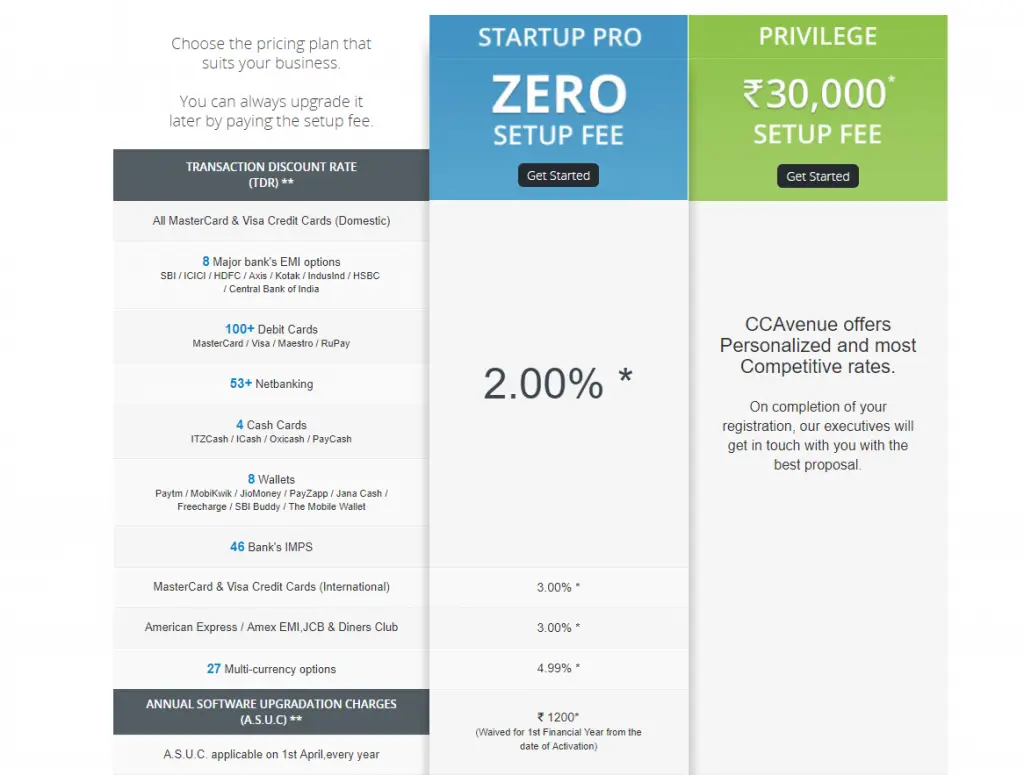

6. CC Avenue

Launched in 2001, CC Avenue is known as the most prominent Indian payment gateway provider. 3 years later, this company decided to expand its global footprint with a new office in Dubai.

Today, it has become a specialist in the field of electronic payments and is widely used by UAE eCommerce businesses.

CC Avenue payment gateway pricing can suit all business levels, from small and medium enterprises to large corporations in the e-commerce market.

Reference Cost: The setup cost is free for the Startup package, and the transaction fee is varied depending on customers’ selected payment method. Check out detailed CCAvenue payment gateway pricing below.

7. Tap

Tap, one of the reputable secure payment gateways in UAE since its establishment in 2013, has emerged as a key player in the industry. With a vast clientele of over 1,000 businesses and major corporations, Tap has facilitated tens of thousands of secure and efficient transactions for consumers worldwide.

Dedicated to ensuring the utmost security, Tap has implemented robust measures throughout its system. By adhering to banking-industry security levels, employing advanced encryption protocols, and maintaining compliance with global PCI DSS security standards, Tap prioritizes the protection of your business and customer data.

Reference Cost: When it comes to pricing, Tap offers a transparent fee structure. They charge a competitive rate of 2.5% per debit card transaction and 3% for credit card transactions, without imposing any monthly fees. This straightforward approach allows businesses to manage costs effectively while enjoying the benefits of Tap‘s secure payment solutions.

We wrote a full review article about the Tap payment gateway, check it out if you want to learn more.

8. PayTabs

The last payment gateway in UAE that we highly recommend is PayTabs (established in 2014), which is well-known for its leading-edge payment processing and fraud prevention system.

This flexible and secure online payment solution enables e-businesses to easily make or receive payments and create and send invoices through agile and unique technology.

Moreover, PayTabs‘s innovative layers of security management are certified by both Visa and MasterCard.

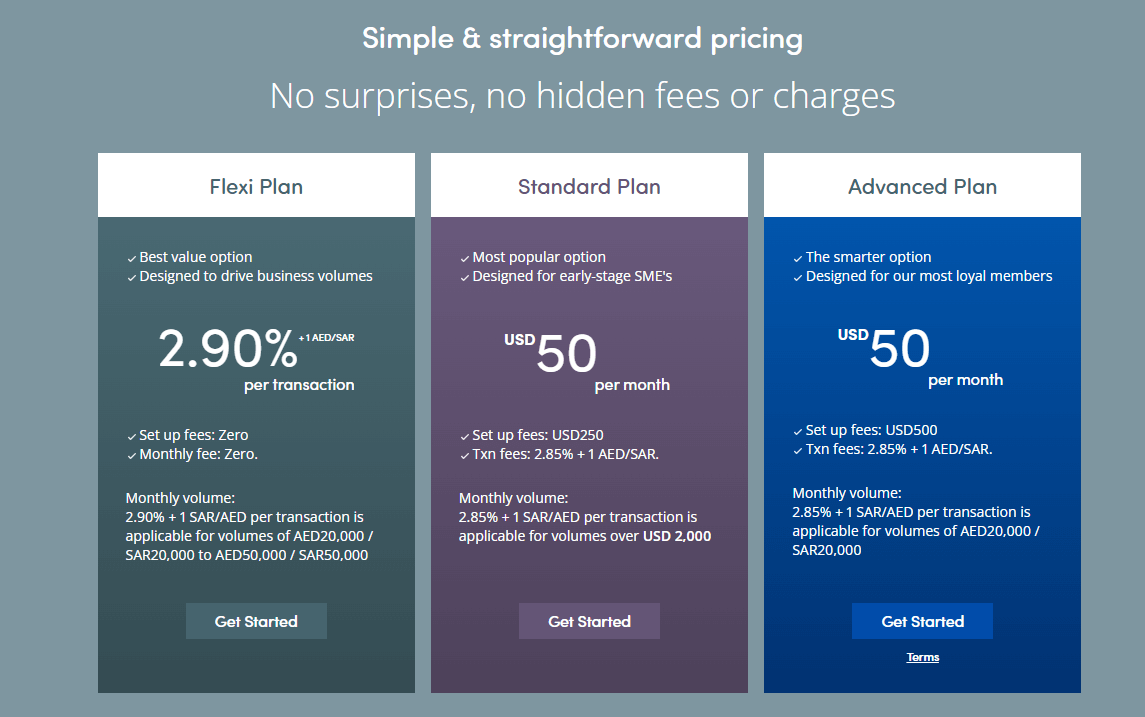

Currently, PayTabs provides you with three main options:

- Flexi Plan – 2.9% + 1 AED/SAR per transaction with zero set up and monthly fees

- Standard Plan – $50 per month, with $250 set up fees and 2.85% + 1 AED/SAR per transaction

- Advanced Plan – $50 per month, with $500 set up fees and 2.85% + 1 AED/SAR per transaction

Additionally, they also provide the Insta Plan for freelancers in Saudi Arabia, UAE, and Egypt.

Wrapping Up

So that’s our list of the top payment gateways in the UAE in 2024.

Each gateway offers a unique set of features tailored to different business needs, from transaction fees and payment methods to integration capabilities and security protocols. By carefully considering these factors, you can select a payment gateway that not only meets your current business requirements but also scales with your growth.

However, selecting a payment gateway is just the beginning. The success of your online business heavily relies on how well you integrate this technology into your ecommerce platform.

To navigate this crucial next step, check out our detailed guide, “Payment Gateway Integration: How to Do It Right”.

This comprehensive article will provide you with the insights and best practices you need to effectively integrate your chosen payment gateway, avoid common pitfalls, and make the most out of your ecommerce solution.

Happy selling!